The Future of Biomethane: Innovations and Trends

By Nick Chapman

In our last post, The potential of Biomethane in Europe, we introduced some of the fundamentals of biomethane and the current state-of-play for the sector in Europe. In this latest addition, we look ahead to the future of biomethane to explore where we think the sector might be heading over the next decade.

Let us start by giving an introduction of where we are today and the story of how we got here. Before biomethane, there was biogas, a mixture of carbon-dioxide and methane produced naturally as organic material decomposes in anaerobic conditions (without oxygen). Research provides evidence that humans discovered biogas for heating and cooking, far back as 900BC [1]. But it was not until the 20th century that biogas started to become industrialized often pushed by short-term energy crises, such as the case of Germany during World War II [2].

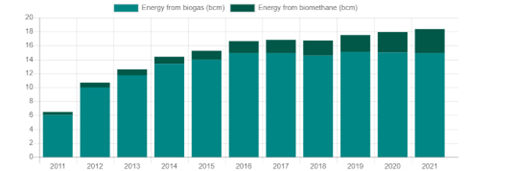

Although biogas was known as a source of energy in Europe, it was mostly considered a by-product of wastewater treatment until the turn of the 21st century, when biogas began receiving significant attention as a potential source of clean energy to address climate change. With the support of policies like Feed-In-Tariff (FIT) programs and clean fuel initiatives, biogas has grown rapidly in Europe. As a result, today there are around 20,000 biogas plants operating, producing around 165TWh (15.5 bcm) of energy [3].

Over the past decade, there has been a transition from using biogas to biomethane. To provide further context, previously biogas was burnt on-site to produce electricity and/or heat, yet today, most new biogas projects are choosing to upgrade to biomethane by removing the carbon-dioxide from biogas. Unlike biogas, biomethane can be used as a direct substitute for natural gas, enabling it to be injected into the natural gas grids or used directly in natural gas vehicles and equipment. This means that biomethane can be used to substitute natural gas in sectors that cannot be easily electrified, such as shipping, heavy goods vehicle (HGV transport)and heavy industry. Today there are 1,322 biomethane plants operating in Europe, producing around 37 TWh (3.5 bcm) per year of energy, approximately 1% of natural gas consumption [3].

Figure 1. European Biogas Association stats on biogas and biomethane production.

Figure 1. European Biogas Association stats on biogas and biomethane production.

With the invasion of Ukraine in 2022, increasing production of biomethane has become a strategic priority in Europe to reduce dependency on imported natural gas from Russia. The ambitious target of 17 bcm per year by 2030 (Fit for 55) is to be practically doubled to 35bcm in the new REPowerEU policy. Achieving this goal has raised concerns from environmental campaigners over potentially land-use change in order to produce biomass feedstock required for the transition with particular concern over the re-emergence of energy crops such as maize which both compete with food production and have indirect environmental impacts. An estimated 5% of agricultural land would need to be set aside for energy crop production if this route were taken. It is therefore critical to accelerate biomethane production whilst avoiding collateral damage to nature and food systems.

To achieve this multi-objective goal, the biomethane sector will need to evolve. Below, we list three major opportunities for the future of biomethane, all of which are supported through case studies via the SEMPRE-BIO project:

- Case Study I: Exploiting green hydrogen: Although hydrogen has received significant attention and investment over the past 5 years, it still faces major problems to establishing supply chains. Difficulties remain in storing and transporting hydrogen, along with a lack of existing infrastructure and users, representing a major bottle neck to the industry. Converting green hydrogen into biomethane (aka. e-methane) via methanation reactions could be a promising option for unlocking the green hydrogen economy. Further, co-locating such projects with existing biomethane plants, which produce biogenic CO2 from the upgrading unit, represent a strong synergy. SEMPRE-BIO will test this approach at a wastewater treatment plant (WWTP) operated by CETAQUA in Spain, which will integrate a novel stack concept based on hydraulic cell compression for the realization of a proton exchange membrane electrolysis (PEMEL) stack developed by PROPULS.

- Case Study II – Exploiting new waste-based feedstocks: Until now, biomethane has only been produced from fermentable biomass, such as energy crops (e.g. maize), manure, sewage and organic municipal waste. However, this only represents about 35% of all biomass waste [4], with the majority made up from high lignocellulosic biomasses such as wood, straw and green waste. Developing new technologies to exploit these feedstocks will be critical to accelerate biomethane production while keeping the pressure off farmlands. In SEMPRE-BIO, a pathway based on biomass pyrolysis and methanation will be developed and tested by TerraWatt to hopefully unlock an efficient and profitable pathway for exploiting green waste. Currently, most biomethane policies in the EU do not recognise this pathway, so the project will also work to inform policy to remove these barriers. According to a feasibility study on the RePowerEU biomethane target, gasification based biomethane like this will need to play an increasingly important role, of 3bcn per year by 2030 (3% of total) raising to 60bcn by 2050 (40% of total) [5].

- Case Study III – Repowering old biogas plants: Many biogas plants from the early 2000s are meeting the end of their regulatory lifetime and will be unable to be profitable at an operative level.. To stop these assets falling into disuse, new policies, business models and technologies will be required to take advantage of existing infrastructure and re-purpose it for biomethane production. Many of these projects are smaller in scale and not near the natural gas network. Therefore, developing technologies to economically purify and transport biomethane at a small scale is required. CRYOinox will be doing just this in the SEMPRE-BIO project, via a novel micro cryogenic purification and liquification technology.

Over the next decades, biomethane will play an increasingly important role in the energy ecosystem Spain alone has identified 2,300 plant opportunities worth around 40 bn€ of investment (Expansion newspaper, June 2023). The success of this effort, the shape it takes and its overall achievement in tackling climate change and increase energy security is not guaranteed. With no doubt new technological developments will be key to success, along with innovation in business models which can be supportive of policies from the EU and its Member States.

References:

[1] The history and technology of biogas: All About Biogas, Article #2 | Skyline Energy

[3] EBA STATISTICAL REPORT 2022 – OPEN INTERACTIVE VERSION (europeanbiogas.eu)

Authors: Nick Chapman

Date: July, 2023

This project has received funding from the European Union’s HORIZON-CL5-2021-D3-03-16 program under grant agreement No 101084297. Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union or the European Commission. Neither the European Union nor the granting authority can be held responsible for them.